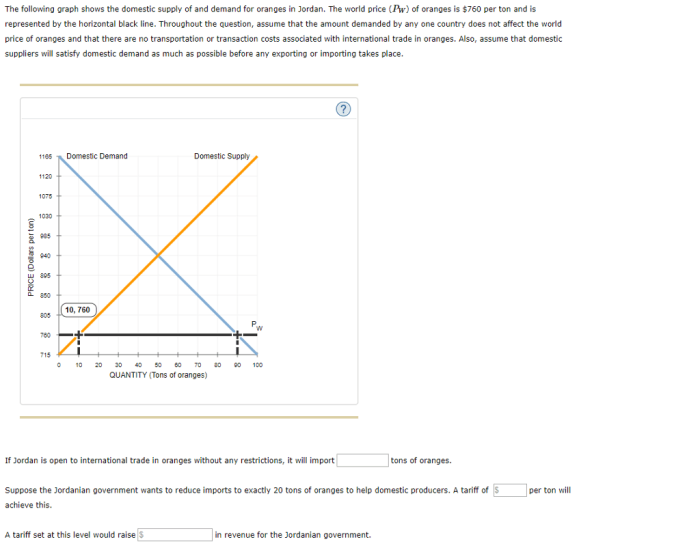

As the graph depicts a market where a tariff is introduced takes center stage, this opening passage beckons readers with gaya akademik dengan tone otoritatif into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

Tariffs, a form of trade restriction, have significant implications for market dynamics and international trade. This comprehensive analysis delves into the economic impacts, trade effects, market dynamics, government objectives, and international context of tariffs, providing a multifaceted understanding of their role in shaping market outcomes.

Economic Impacts

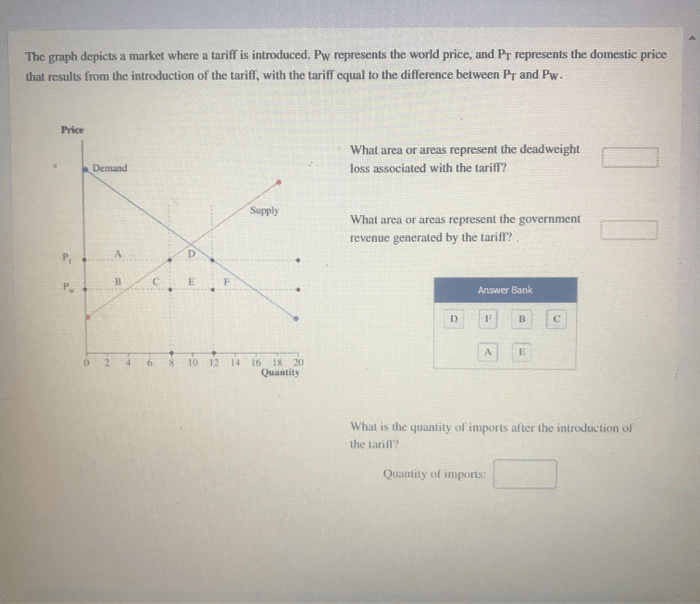

The introduction of a tariff, a tax on imported goods, has significant economic implications. It affects consumer surplus, producer surplus, equilibrium price, quantity, and deadweight loss.

Impact on Consumer Surplus and Producer Surplus, The graph depicts a market where a tariff is introduced

A tariff reduces consumer surplus by increasing the price consumers pay for imported goods. Conversely, it increases producer surplus by raising the price domestic producers receive for their goods.

Impact on Equilibrium Price and Quantity

A tariff raises the equilibrium price and lowers the equilibrium quantity in the market. This is because the tariff makes imported goods more expensive, reducing demand and shifting the supply curve to the left.

Deadweight Loss

The deadweight loss associated with a tariff represents the net loss to society due to inefficient allocation of resources. It is the area between the old and new consumer and producer surplus triangles.

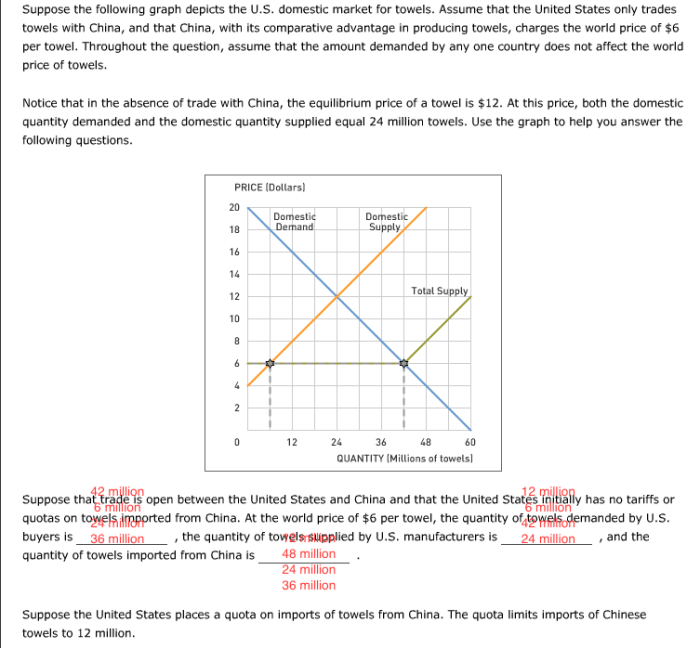

Trade Effects

Impact on Volume of Imports and Exports

A tariff reduces the volume of imports by making them more expensive. It may also reduce exports if the tariff is imposed on goods that are exported.

Impact on Trade Deficit or Surplus

A tariff can affect the trade deficit or surplus by reducing imports and/or exports. The impact depends on the relative changes in imports and exports.

Trade Diversion and Trade Creation

A tariff can lead to trade diversion, where imports from a low-cost producer are replaced by imports from a higher-cost producer. It can also lead to trade creation, where domestic production increases due to the tariff.

Market Dynamics

| Before Tariff | After Tariff | |

|---|---|---|

| Equilibrium Price | P1 | P2 |

| Equilibrium Quantity | Q1 | Q2 |

| Consumer Surplus | CS1 | CS2 |

| Producer Surplus | PS1 | PS2 |

| Deadweight Loss | 0 | DWL |

Factors Influencing Tariff Effectiveness

- Elasticity of demand and supply

- Size of the tariff

- Availability of substitutes

- International trade agreements

Decision-Making Process for Producers and Consumers

- Producers: Decide whether to increase production or shift to alternative markets.

- Consumers: Decide whether to reduce consumption or switch to domestic substitutes.

Government Objectives

Governments implement tariffs for various objectives, including:

- Protecting domestic industries

- Generating revenue

- Promoting specific economic sectors

- Addressing national security concerns

Examples of Targeted Industries or Products

- Agriculture

- Manufacturing

- Steel

- Automobiles

Economic and Political Motivations

Tariff policies can be driven by both economic and political motivations, such as:

- Protecting jobs

- Reducing competition

- Gaining political support

- Influencing trade negotiations

International Context: The Graph Depicts A Market Where A Tariff Is Introduced

Role of International Trade Agreements

International trade agreements, such as the World Trade Organization (WTO), regulate tariffs and aim to reduce trade barriers.

Consequences of Tariff Disputes

Tariff disputes between countries can lead to:

- Trade wars

- Retaliatory tariffs

- Economic damage

Comparative Advantage and Tariffs

The concept of comparative advantage suggests that countries should specialize in producing and exporting goods where they have a lower opportunity cost. Tariffs can interfere with this principle by protecting inefficient domestic industries.

Question Bank

What is the primary economic impact of a tariff?

Tariffs primarily impact consumer and producer surplus. Consumers face higher prices, reducing their surplus, while producers benefit from increased prices, boosting their surplus.

How do tariffs affect the equilibrium price and quantity?

Tariffs raise the equilibrium price and reduce the equilibrium quantity in the market. This occurs because tariffs make imports more expensive, leading to a decrease in supply and an increase in demand for domestic goods.

What is deadweight loss, and how does it relate to tariffs?

Deadweight loss refers to the economic inefficiency caused by tariffs. It represents the reduction in total welfare due to the misallocation of resources. Tariffs can create deadweight loss by distorting market signals and reducing overall economic efficiency.