Which legally required form divulges information about financial advisors – The legally required disclosure form for financial advisors serves as a crucial tool for investors, providing essential information about the professionals entrusted with managing their financial well-being. This form empowers investors to make informed decisions and promotes transparency within the financial advisory industry.

The disclosure form mandates financial advisors to disclose specific details, including their educational background, professional experience, disciplinary history, and any potential conflicts of interest. By understanding the advisor’s qualifications and potential biases, investors can assess their suitability and make informed choices.

Legally Required Form for Financial Advisor Disclosure

Financial advisors are required by law to provide clients with a disclosure form that Artikels their qualifications, experience, and any potential conflicts of interest. This form is designed to help investors make informed decisions about whether to work with a particular advisor.

The disclosure form typically includes the following information:

- The advisor’s name, address, and contact information

- The advisor’s education and experience

- The advisor’s investment philosophy and strategies

- Any fees or commissions that the advisor charges

- Any conflicts of interest that the advisor may have

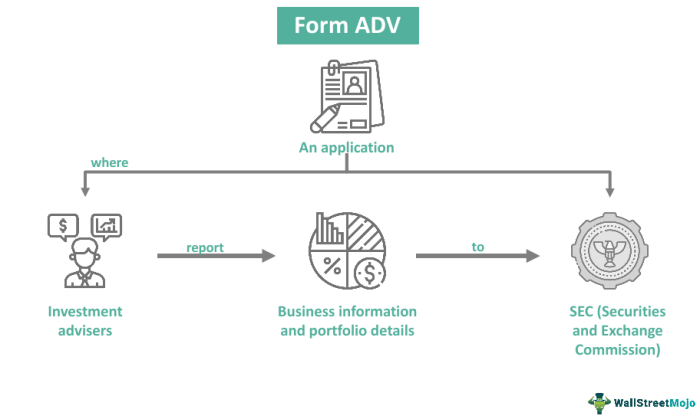

The regulatory body responsible for enforcing the use of the disclosure form is the Securities and Exchange Commission (SEC).

Key Elements of the Disclosure Form

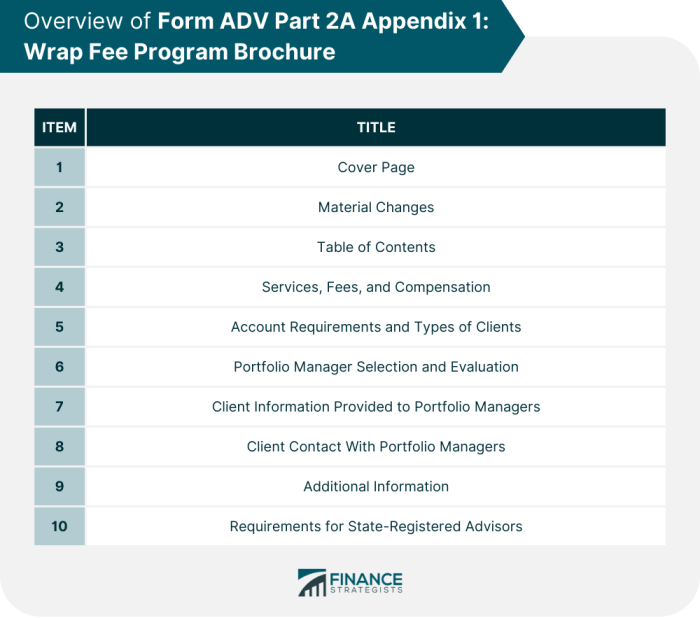

The disclosure form is divided into several sections, each of which provides information about a different aspect of the advisor’s background and qualifications.

The following are some of the most important sections of the disclosure form:

- Personal Information:This section includes the advisor’s name, address, and contact information.

- Education and Experience:This section provides information about the advisor’s education and experience, including their degrees, licenses, and certifications.

- Investment Philosophy and Strategies:This section describes the advisor’s investment philosophy and strategies. It explains the types of investments that the advisor typically recommends and the factors that they consider when making investment decisions.

- Fees and Commissions:This section discloses any fees or commissions that the advisor charges. It also explains how the advisor is compensated.

- Conflicts of Interest:This section discloses any conflicts of interest that the advisor may have. A conflict of interest exists when the advisor has a financial or personal interest that could influence their investment recommendations.

Each of these sections is important in understanding the advisor’s background and qualifications. Investors should carefully review all of the information in the disclosure form before making a decision about whether to work with a particular advisor.

Implications of the Disclosure Form

The disclosure form is an important tool for investors. It provides them with the information they need to make informed decisions about whether to work with a particular advisor.

The disclosure form can also help to protect investors from fraud and abuse. By providing investors with information about the advisor’s background and qualifications, the disclosure form helps them to avoid working with advisors who are not qualified or who have a history of misconduct.

The disclosure form has also had a significant impact on the financial advisory industry. It has led to greater transparency and accountability among advisors. It has also helped to raise the level of professionalism in the industry.

Comparison with Other Disclosure Requirements: Which Legally Required Form Divulges Information About Financial Advisors

The legally required disclosure form for financial advisors is similar to other disclosure requirements used in the financial industry.

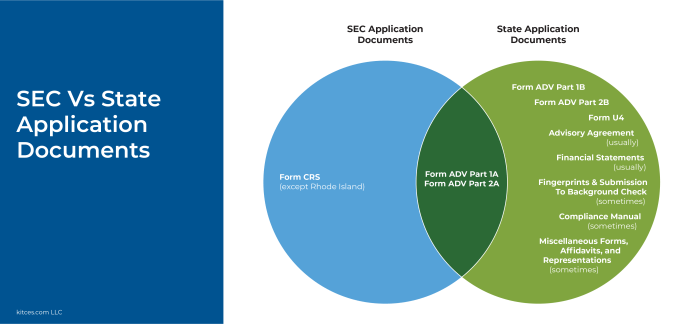

For example, the Securities and Exchange Commission (SEC) requires broker-dealers to provide clients with a disclosure document called the Form ADV. The Form ADV provides information about the broker-dealer’s business, its employees, and its investment strategies.

The disclosure form for financial advisors is also similar to the disclosure requirements for investment funds. Investment funds are required to provide investors with a prospectus that Artikels the fund’s investment objectives, strategies, and risks.

However, there are some key differences between the disclosure form for financial advisors and other disclosure requirements.

For example, the disclosure form for financial advisors is more detailed than the Form ADV. The disclosure form for financial advisors also requires advisors to disclose any conflicts of interest that they may have.

Future Trends in Disclosure Requirements

The disclosure form for financial advisors is likely to change in the future.

One trend is towards greater transparency. Regulators are increasingly requiring advisors to disclose more information about their backgrounds, qualifications, and fees.

Another trend is towards the use of technology. Regulators are exploring ways to use technology to make disclosure more accessible and easier to understand.

These trends are likely to continue in the future. As a result, investors can expect to have more information about financial advisors than ever before.

General Inquiries

What information is disclosed on the legally required form for financial advisors?

The form includes details such as the advisor’s education, experience, disciplinary history, and potential conflicts of interest.

Who is responsible for enforcing the use of the disclosure form?

Regulatory bodies such as the Securities and Exchange Commission (SEC) are responsible for enforcing the use of the disclosure form.

What are the potential consequences of failing to provide accurate information on the disclosure form?

Failure to provide accurate information may result in disciplinary action, fines, or even criminal charges.